How Age Affects Your Cats Insurance Premiums

This article discusses the impact of the aging process on pets and how it affects their insurance premiums. It covers the factors influencing the cost of common health concerns for older cats and explores how age is utilized to determine insurance rates. To understand more about senior cat insurance premiums, read the full article.

Additionally, the article provides suggestions for selecting insurance for senior cats and outlines methods for reducing premiums. The article also examines the relevance of age in cat insurance coverage.

Key Takeaways:

- 1.

- Age is a major factor in determining the cost of cat insurance premiums, with older cats being more expensive to insure due to increased risk of health issues.

- Common age-related health conditions, such as arthritis and dental disease, can also increase insurance premiums for senior cats.

- When choosing insurance for your senior cat, consider coverage for pre-existing conditions, annual limits, and potential waiting periods before coverage begins.

- To lower insurance premiums for older cats, consider increasing deductibles, bundling insurance with other policies, and maintaining regular preventative care for your feline friend.

2.

3.

4.

Understanding Cat Insurance Premiums

Understanding cat insurance premiums is essential for safeguarding a pet cat’s well-being. Factors such as the chosen policy coverage level, deductible amount, and the cat’s age play a significant role in determining cat insurance premiums.

The policy coverage level is a crucial factor that influences cat insurance premiums. Comprehensive policies that cover accidents, illnesses, and routine care typically have higher premiums, while basic policies with limited coverage come with lower premiums. Opting for a higher deductible can lower monthly premiums but may result in higher out-of-pocket costs when filing a claim.

Pet owners should carefully assess these factors, compare premiums from various insurers, and select a policy that aligns with their budget while ensuring adequate protection for their cat.

What Factors Affect the Cost?

The cost of cat insurance is influenced by several factors, including the coverage selected, the age of the cat, whether the cat has any pre-existing conditions, and the overall health of the cat.

The coverage options chosen by policyholders play a significant role in determining the cost of pet insurance. Full coverage plans, such as comprehensive insurance policies that offer coverage for accidents, illnesses, and preventive care, generally come with higher premiums.

Age is another key factor, as older cats are more prone to health issues, leading to increased insurance costs. Pre-existing health conditions in cats can also drive up premiums or result in lower coverage limits. Certain pre-existing conditions may lead to higher premiums or even exclusions in the cat insurance coverage for those specific conditions.

The Impact of Age on Cat Insurance

The impact of age on cat insurance is significant, as older cats tend to have higher premiums due to increased risks of sickness and claims. Insuring an older cat requires careful selection and understanding of potential health-related problems.

As cats age, they become more susceptible to various diseases, including kidney disease, diabetes, and arthritis, affecting both their quality of life and the cost of veterinary care. Insurers evaluate the heightened risk of older cats based on their medical history, breed, and overall health conditions.

Premiums for cat insurance are adjusted to account for the increased likelihood of claims and the potential expenses associated with treating age-related ailments.

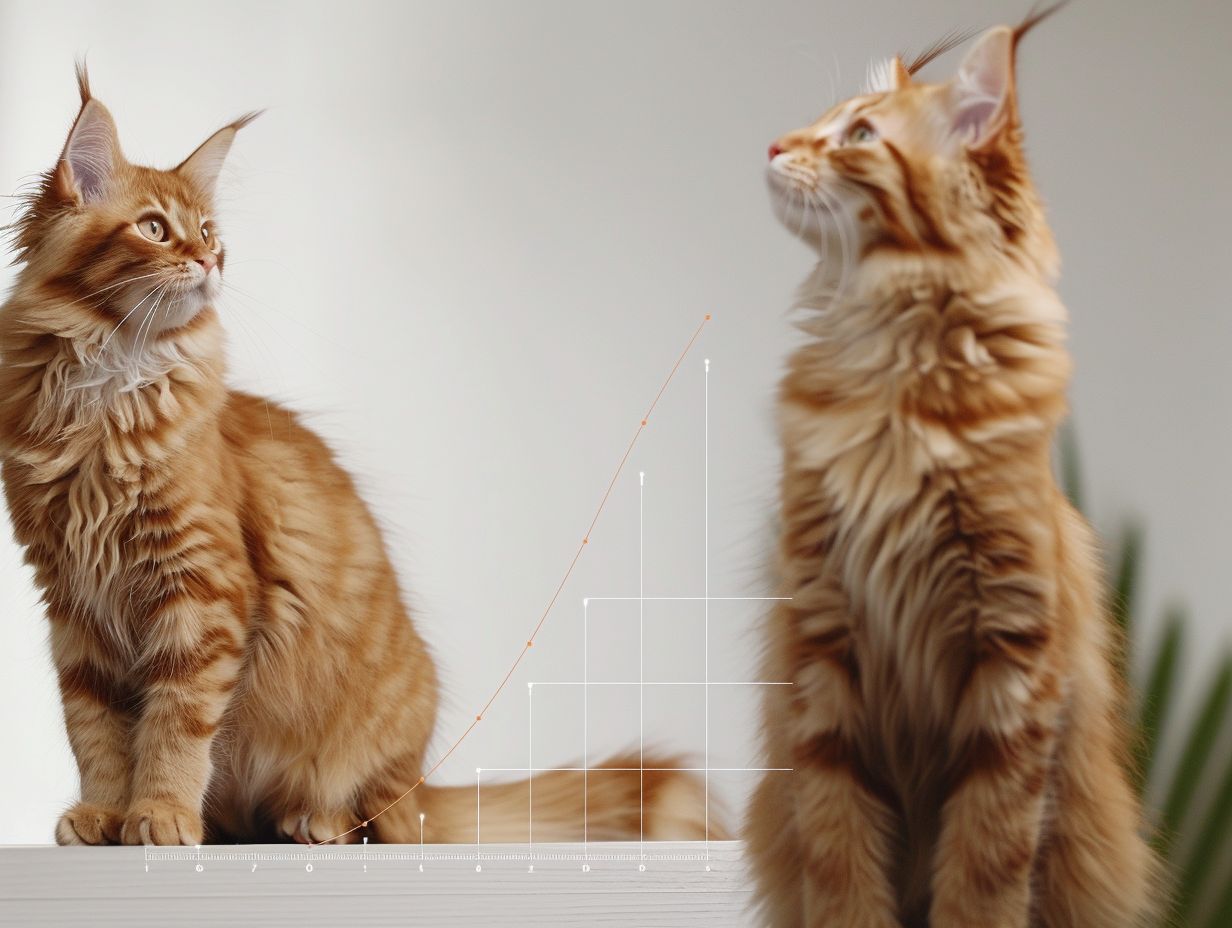

How Age Affects Premiums

Age plays a significant role in determining the cost of cat insurance, with premiums typically higher for older cats. As cats age, the likelihood of developing age-related health conditions increases, leading to higher treatment costs and subsequently, insurance premiums.

Insurance companies consider the elevated risk of chronic age-related ailments like arthritis, kidney disease, and diabetes, which are prevalent among senior cats. These conditions often necessitate ongoing management and specialized veterinary care, which can result in substantial expenses.

To mitigate these potential costs, insurance companies offer tailored coverage options for older cats, including coverage for prescription medications, diagnostic tests, and preventive care. By adjusting premiums based on the cat’s age, insurance companies aim to strike a balance between providing financial protection to the owner and covering the potential expenses associated with treating age-related illnesses.

Common Health Concerns for Older Cats

Common health concerns for older cats include age-related conditions such as arthritis, diabetes, and heart disease. Older cats often require emergency veterinary care at a higher rate, underscoring the importance of comprehensive coverage for cat owners.

Arthritis, a common condition in older cats, can lead to joint pain and reduced mobility. Diabetes is another prevalent disease that necessitates regular monitoring and management in older cats. Heart disease is also more frequently observed in older cats and if not identified early, can result in significant health complications.

Emergency care coverage for older cats is crucial as their age-related conditions can unexpectedly escalate into health crises. Insurance coverage plans tailored to older cats can assist in covering diagnostics, medications, and treatments to effectively manage their conditions and uphold their quality of life.

Age-Related Health Conditions

Older cats often experience age-related health conditions that necessitate continuous treatment and care, potentially posing challenges for pet owners due to annual coverage limits. Common age-related health issues in cats encompass dental disease, arthritis, chronic kidney disease, and hyperthyroidism, all of which typically require veterinary attention, medications, and specialized diets to address symptoms and uphold a satisfactory quality of life.

Insurance policies with annual coverage caps might restrict the reimbursement amount for these treatments, leaving pet owners responsible for expenses exceeding the limit. It is advisable for pet owners to carefully review policy terms, considering the long-term implications, especially when securing insurance for senior cats.

Choosing the Right Insurance for Your Senior Cat

When Choosing the Right Insurance for Your Senior Cat, key considerations include coverage options, the reputation of the insurer, and renewal policies. It is crucial to select a policy that aligns with your cat’s healthcare needs as they age and experience declining health.

Evaluation of policy benefits is essential, with coverage for common issues affecting senior cats like arthritis, dental care, and chronic illnesses. The insurance company should have a strong reputation for efficiently and fairly processing claims.

The renewal process should be transparent, with carriers providing clear information on premium changes as the pet ages. Opting for a reputable carrier ensures that your senior cat receives the necessary care without becoming a financial burden when health issues arise.

Factors to Consider

The value of insurance for senior cats is significantly influenced by coverage flexibility, reimbursement policies, out-of-pocket expenses, and the option to utilize a dedicated pet care savings account. Coverage flexibility is crucial as it allows you to adjust policy coverage and premiums over time to cater to the specific health needs of your aging senior cat.

When selecting insurance for your senior cat, this factor should be considered carefully. The reimbursement process is another key aspect, as it determines the time it takes for reimbursement to begin after a claim is submitted. Understanding the reimbursement timeline of your chosen policy enables you to plan for out-of-pocket expenses and leverage savings accounts to alleviate these costs, ensuring optimal utilization of the policy’s value.

Ways to Lower Insurance Premiums for Older Cats

To lower insurance premiums for older cats, pet owners can implement changes to manage pet healthcare costs more effectively. It is crucial to compare insurance companies and policies to secure valuable coverage for elderly cats.

Opting for a higher deductible is a practical approach to reducing insurance premiums for older cats. By choosing a higher deductible, pet owners can decrease their monthly premiums, making insurance more budget-friendly.

Seeking policies that include wellness benefits can help offset the expenses of routine pet care as cats age. Exploring discounts for multiple pet insurance or loyalty rewards from insurance providers can be beneficial.

Regularly engaging with insurance companies to assess and adjust coverage as necessary to ensure cost-effective and comprehensive coverage for aging feline companions is essential.

Tips for Reducing Costs

By implementing cost-reducing tips, you can offset the drawbacks of high premiums for specific cat breeds and emergency care. Different cat breeds come with varying health considerations, some of which are unique to a particular breed and can impact insurance costs.

For instance, Siamese and Ragdoll cats may have a higher susceptibility to certain genetic conditions, making comprehensive insurance coverage a valuable investment.

Additionally, as cats age, they may necessitate more frequent veterinary visits. Emergency coverage can offer added reassurance during unforeseen health emergencies. By exploring insurance options tailored to your cat’s specific needs and carefully comparing policies, you can ensure that your pet receives top-notch care without incurring exorbitant expenses.

Frequently Asked Questions

How does my cat’s age impact their insurance premiums?

As your cat gets older, they may be more prone to health issues, resulting in higher insurance premiums.

At what age should I consider getting insurance for my cat?

It is recommended to get insurance for your cat while they are still young and healthy, as premiums tend to increase with age.

Do insurance companies have different premium rates for different age groups?

Yes, insurance companies typically have different premium rates for kittens, adult cats, and senior cats due to the varying levels of risk and potential health issues.

How much of an impact does age have on my cat’s insurance premiums?

The impact of age on insurance premiums can vary depending on your cat’s specific health and medical history. However, in general, older cats may have higher premiums due to increased health risks and potential claims.

Do insurance companies offer discounts for senior cats?

Some insurance companies may offer discounts for senior cats, but it’s important to compare different policies and their premiums to find the best deal for your aging feline.

Is it still worth getting insurance for my senior cat?

While premiums may be higher for senior cats, it is still worth considering insurance to help cover unexpected vet bills and provide peace of mind for your cat’s health and well-being.